Mandatory Implementation of Two-Factor Authentication (2FA) for e-Way Bill & e-Invoice Systems from April 2025

Methods to Receive OTP for 2FA

Users can generate and receive OTPs using the following methods

- SMS (Short Message Service): The OTP will be sent to the taxpayer’s registered mobile number via SMS. Users must ensure that their registered mobile number is active and capable of receiving text messages.

- Sandes App: The Sandes App is a secure government-provided messaging application that allows users to receive OTPs directly within the app. It offers an additional layer of security and can be used as an alternative to SMS-based OTPs.

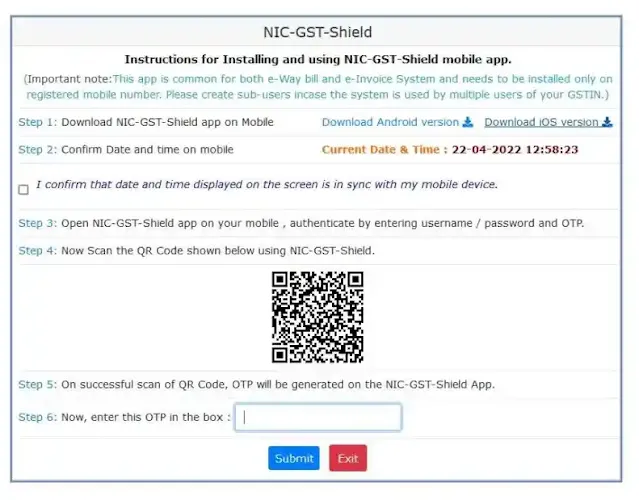

- NIC-GST-Shield App: This is a specialized mobile application developed by NIC for offline OTP generation. The OTP generated through this app refreshes every 30 seconds, ensuring enhanced security without requiring an active internet connection.

- Email OTP (Upcoming Feature): The government is also considering introducing OTP delivery via registered email addresses for added convenience and security. This feature, if implemented, will provide users with another authentication option, reducing dependency on mobile networks.

- Authentication via Aadhaar-based OTP (Future Implementation): Discussions are underway to integrate Aadhaar-based OTP authentication to further streamline security measures. This would allow users to authenticate themselves using an OTP sent to their Aadhaar-linked mobile number.

Steps to Enable 2FA

To activate Two-Factor Authentication (2FA) and enhance the security of your e-Way Bill and e-Invoice portal access, follow these steps:

- Log in to the e-Way Bill System: Access the e-Way Bill or e-Invoice system using your existing username and password.

- Navigate to the '2-Factor Authentication' Option: Locate this option in the main menu under the security settings.

- Enable 2FA: Click on the 'Enable 2FA' button to initiate the process.

- Choose OTP Delivery Method: Select your preferred method for receiving the OTP – SMS, Sandes App, or NIC-GST-Shield App.

- Verify and Confirm: Enter the OTP sent via the selected method and confirm your registration.

- Completion and Future Logins: Once enabled, all future logins (including those by sub-users under the same GSTIN) will require OTP authentication for enhanced security.

Additional Considerations

- Updating Contact Information: Ensure that the registered mobile number and email ID on the GST portal are up to date to avoid login issues.

- Alternative Access in Case of OTP Delays: If an OTP is not received, users can regenerate it or use the NIC-GST-Shield App for offline OTP authentication.

- Deactivation of 2FA: If needed, users can disable 2FA by following the same steps and selecting the 'Disable 2FA' option, though this is not recommended for security reasons.

Creation and Management of Sub-Users

The e-Way Bill and e-Invoice system allows primary users (taxpayers) to create and manage sub-users under their GSTIN. This feature helps businesses efficiently distribute workload while maintaining control over operations. The key functionalities include:

- Sub-User Creation: The primary user can create multiple sub-users based on business requirements. Each sub-user is assigned a unique login ID and password.

- Permission Assignment: The primary user can define specific roles and access levels for sub-users, such as:

- Generating, canceling, or updating e-Way Bills

- Viewing reports and transaction logs

- Accessing invoice-related data

- Limited access to only certain GSTIN functions

- Activity Monitoring: The system records all actions performed by sub-users, allowing the primary user to track activities, detect anomalies, and ensure compliance with security protocols.

- Authentication and Security: With 2FA enabled, sub-users will also be required to authenticate their logins using OTP verification, preventing unauthorized access.

- Updating or Deactivating Sub-Users: The primary user can:

- Modify access rights as per changing business needs

- Reset passwords if required

- Deactivate sub-user accounts in case of employee changes or misuse concerns

- Mobile Number Registration for Authentication: The registered mobile number of sub-users can be updated to ensure seamless authentication. It is advisable to keep mobile details current to avoid login disruptions.

By effectively managing sub-users, businesses can streamline operations while maintaining security and accountability across the e-Way Bill and e-Invoice portals.

Importance of 2FA Implementation

The implementation of Two-Factor Authentication (2FA) represents a significant advancement in securing access to the e-Way Bill and e-Invoice portals. Given the increasing number of cyber threats and fraudulent activities in the digital financial ecosystem, this added layer of security ensures that only authorized users can access these crucial tax-related platforms.

Key Benefits of 2FA Implementation

- Enhanced Security: Reduces the risk of unauthorized access, hacking, and identity theft.

- Fraud Prevention: Prevents misuse of GST credentials for fraudulent activities.

- Data Protection: Safeguards sensitive taxpayer information from data breaches.

- Regulatory Compliance: Aligns with cybersecurity best practices and government directives.

- User Accountability: Ensures login traceability and access monitoring.

GSTN’s Temporary Relief and Future Mandate

Recognizing the need for a smooth transition, GSTN has temporarily made Two-Factor Authentication (2FA) optional. However, this is part of a phased implementation strategy:

- From January 1, 2025: Mandatory for taxpayers with an Aggregate Annual Turnover (AATO) exceeding Rs. 20 crores.

- From February 1, 2025: Mandatory for taxpayers with an AATO exceeding Rs. 5 crores.

- From April 1, 2025: Mandatory for all taxpayers and users.

Conclusion

Two-factor authentication stands out as an essential security improvement for safeguarding taxpayers against unauthorized access and fraud. Businesses are encouraged to enable 2FA as a proactive measure to avoid last-minute disruption and make their data more secure. The introduction of 2FA allows data security to be positioned amid threats, which strengthens the government in engendering trust in the GST compliance ecosystem.

Disclaimer: This article is meant for informational purposes based on public sources and official notifications. Readers should check with government guidance, taxation experts, or legal professionals. The author and publisher bear no responsibility for such errors or consequences.